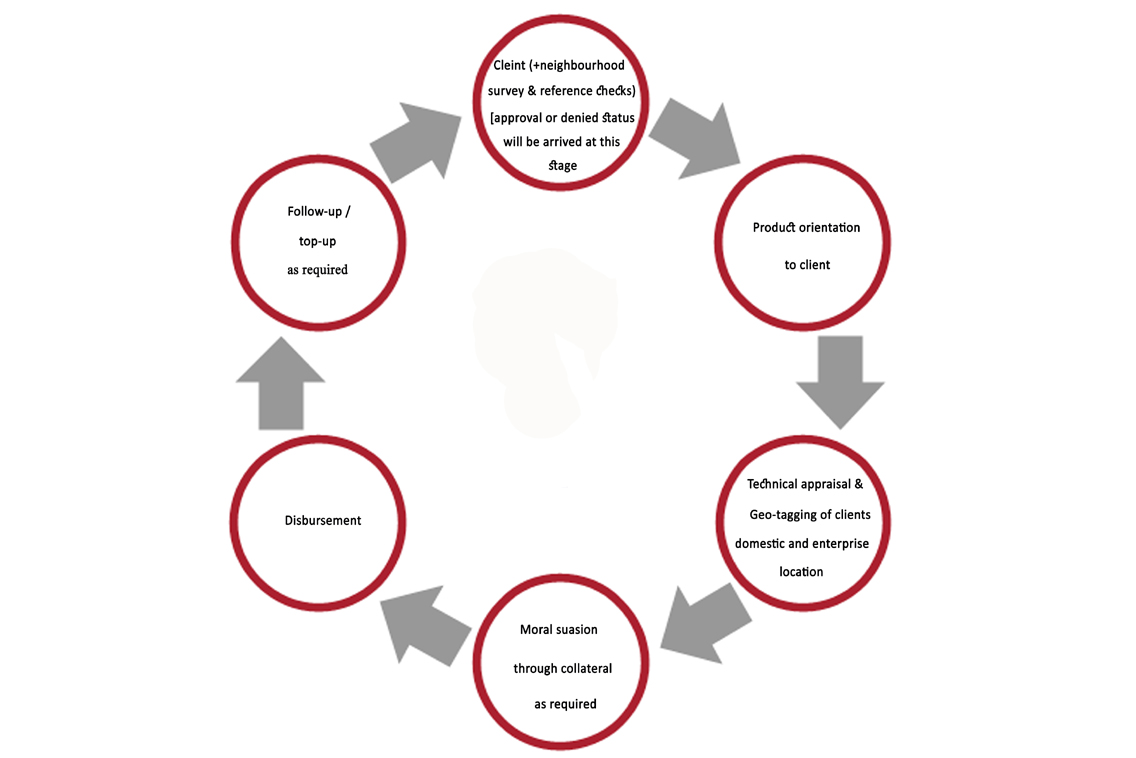

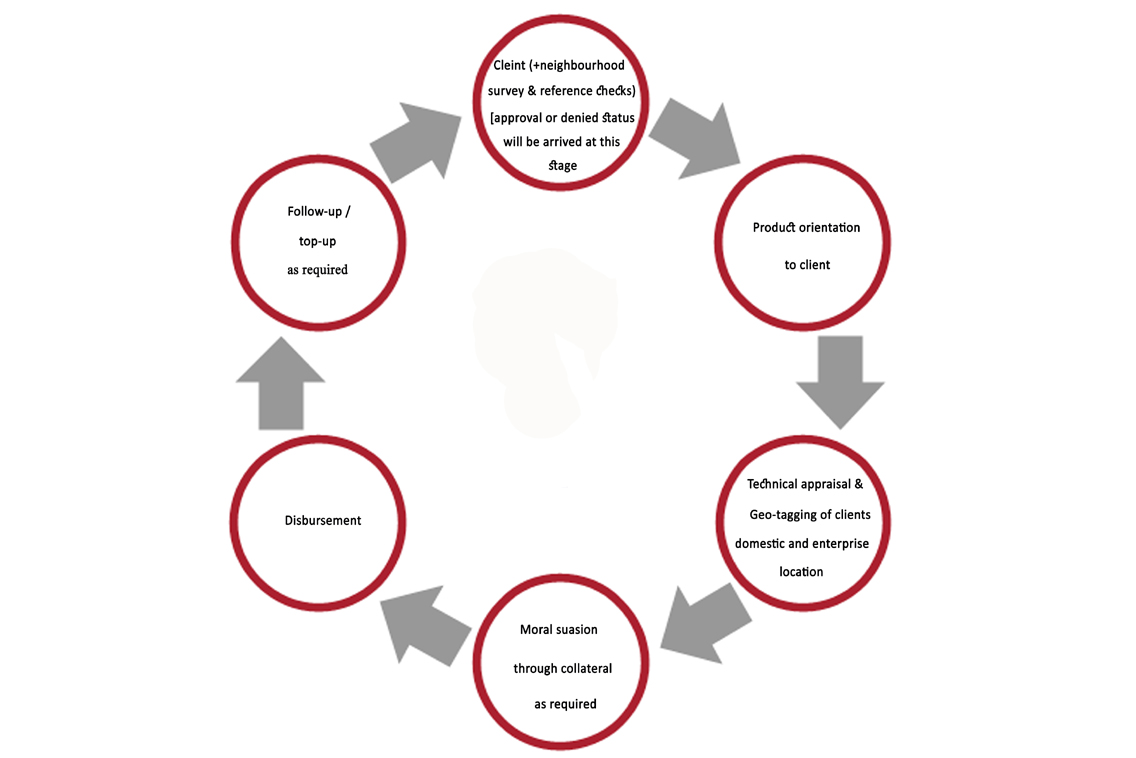

Methodology

MSME:

Short term loans are offered ranging for requirements of a week to 3 months at attractive rates. This is mainly to address cash flow requirements of the enterprise. Registration is done once and process for availing loan is less than 24 hours. You can now do your business with no credit worries.

Loan amount: upto a maximum of Rs. 2.00 Lakhs

Small business:

Credit for small business-retailers, small manufactures, repairers, etc,-is essential to continue doing business regularly and also to make the next step try adding more goods or tools. Present business historical track record is sufficient for clearing a loan. Easy EMI’s, flexible interest rates will be customized for the client.

Loan amount: upto a maximum of Rs. 50,000

Housing:

GFin is working with Habitat India in providing housing loans for low income households for building and repairing their homes.

Loan amount: upto a maximum of Rs. 1.75 Lakhs

Personal:

For all your personal needs, flexible plans will be customized on client basis. Health, Education fee, and household requirements: name it and we can support you.

Loan amount: upto a maximum of Rs. 1.00 Lakhs

Agri related:

Planning for dairy, goat, sheep, poultry, poly-house and organic farming is now possible for you. Share your marketing strategy or sales data and we can workout a credit plan together.

Loan amount: upto a maximum of Rs. 1.00 Lakh